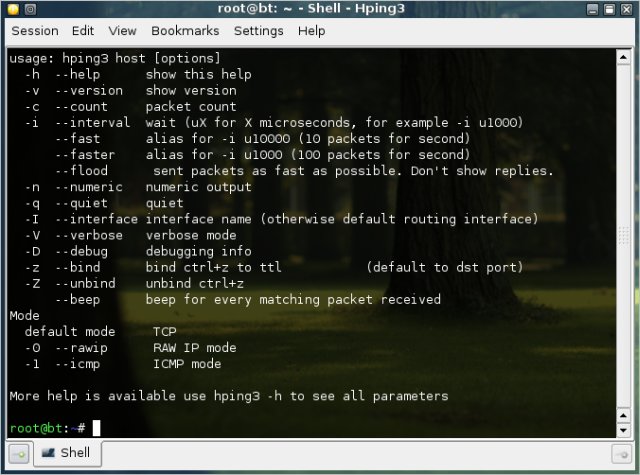

They consist of injecting malicious code onto the public web pages of a website that that a small group of people usually visit. “Watering hole” attacks are considered an evolution of spear phishing attacks. Never enter personal information in a pop-up screen, or click on it.

Syn bank netbanking download#

Don’t click on links, download files, or open email attachments from unknown senders.Never divulge personal information via phone or on insecure websites (TCP/IP port 80.).Verify online accounts regularly to ensure that no unauthorized transactions have been made.Take care with email and other online communication from unknown senders.Request quick action when users are threatened with frightening information.Request confirmation for personal or financial information with high urgency.The following are a few good practices to avoid the insidious threat: Compromising a single shared hosting server, it’s possible to exploit hundreds or even thousands of websites at a time for the attacks.ĭespite the simplicity of the schema implemented, phishing attacks are still very aggressive and represent a serious problem for the banking system.

Syn bank netbanking update#

The hackers compromise the servers and update their configuration so that phishing pages are displayed from a particular subdirectory of each domain hosted on the machine. The APWG Global Phishing Survey report states that the number of phishing attacks that targeted shared web hosting represented 47% of overall phishing attacks.

Phishers are concentrating their efforts to break into hosting providers with unprecedented success and abusing of their resources to conduct large scale phishing attacks. The last edition of the APWG Global Phishing Survey report revealed that attackers increasingly target shared web hosting servers for use in fraudulent activities such as mass phishing attacks. According to Kaspersky Labs, nearly 20.64% of all phishing threats registered between May 2012 and April 2013 were aimed at accounts of banks and other financial organizations worldwide.Ĭyber crime involves an increasingly sophisticated phishing attacks. Phishing attacks hit almost every sector, predominantly banking, e-payment systems and e-auctions. A recent survey conducted by Kaspersky revealed that about 37% of all banks were affected by phishing attacks at least once over the previous 12 months. In literature, there are several variants of phishing, many of them involve the use of malware specifically designed to steal credentials from victims while hiding evidence of an attack.Ī report issued by McAfee on phishing activities detected in Q2 2013, companies from the United States are the most targeted, suffering 80% of all attacks.

They request the user to submit sensitive information such as passwords, credit card numbers and bank account details Phishing messages usually take the form of fake notifications from banks, providers, e-payment systems and other organizations. Phishing attacks use social engineering techniques mixed with technical tricks to fool the user and steal sensitive information and banking account credentials. The malicious email could contain a link to the fake website or could include an attachment that once opened, involves exactly the same task. The emails request victims to click on a link to go to a website that replicates a bank’s website. In the classic attack scheme, fraudsters send e-mails or advertisements to the victims with content that looks like they were sent by a bank or by a credit card company. The websites are designed to coax customers to divulge financial data, such as account credentials, social security numbers and credit card numbers. In a typical phishing scheme, spoofed emails lead users to visit infected websites designed to appear as legitimate ones. Phishing attacks make large use of social engineering techniques to fool the user and steal sensitive information and banking account credentials. Practically every sector of society is targeted by cyber criminals with various techniques. The number of phishing attacks against banking systems is constantly growing. We will analyze the most insidious cyber threats to online banking services, including phishing attacks, malware-based attacks and DDoS.

What are the main methods used by cyber crime, and how they have evolved over the years? The improvement of online banking system, and its increased use by consumers worldwide has made this service a privileged target for cyber criminals.

0 kommentar(er)

0 kommentar(er)